How to Buy Stocks Online

These days where almost everything is a competition, earning big amount of money is really very challenging. Many people do every possible and right means just to earn money in order for them to survive and buy the things that they need and want. In fact, some of them even try buying stocks online because of many reasons. But, the two main reasons why people buy stocks online is that buying stocks can really give them a chance to earn higher amount of money and purchasing it and through online can also definitely saves more of their time and effort compared to getting it in person.

Moreover, if you are planning to buy stocks online, then you probably need the help of an expert stock broker and at the same time is permitted to purchase things securely for you. However, before going or looking for the possible stock broker that can help you, it’s important first to know what kind of broker is the best for you. These days there are different classes of stock brokers, which are ranging from the cheapest and simplest order-takers up to the most expensive brokers that can provide you a full service, detailed advice, recommendations and financial analysis. The categories of stock brokers are the discount or online brokers, full service brokers, discount stock brokers with assistance and money managers.

Discount or online brokers

Discount or online brokers serve as your order-takers if ever you want to buy stocks online. Since there will be no typical office for you to visit and there is also no expert advisors or financial planners that may help you. Additionally, the only communication you would do with a discount broker is through phone or by the internet. The cost that you will also need to pay will depend on every share or transaction that you want your broker to do, giving you the chance to only open an account using lesser money. The account that you have made together with your discount or online broker will also let you to purchase and sell options/ stocks immediately through internet.

Since this kind of stock broker doesn’t provide any investment advice, tips for your stocks and any kind of recommendations, you definitely need to have enough knowledge about the matter. The only thing that he will do for you is to help you with the technical support which is also helpful for you if you want to buy stocks online. However, discount brokers also normally offer an investment-related research, resources and website links for you, but those are usually a third party providers. Although, if you know in yourself that you have the needed knowledge when it comes to it or if you are willing to learn about the things in investing stocks without spending too much amount of money, then discount or online stock broker would be the best for you.

Discount stock brokers with assistance

This kind of broker is mostly similar to the discount or online stock brokers. But, the only difference between the two is that they normally charge a very little amount for you to pay for the extra help that you will ask from them. However, the assistance or help they will make for you usually only includes small number of resources or information that can help you if you will buy stocks online. They can also be working at the same with companies like the basic discount or online brokers which offers an upgradeable services or accounts. However, the discount stock brokers with assistance will only give you any kind of recommendations or advice when it comes to your online stocks investment. Or in other words, they will just offer or give you in-house reports and research or anything that includes tips for your stock investments that can also be a big help for you to buy stocks online.

Full service stock broker

This type of dealer is considered as traditional stock brokers who spend with you to know you more financially and personally. Full service stock broker also consider different factors like your personality, marital status, income, debts, age, risk tolerance, lifestyle, assets and many more. With it, they will definitely develop the best financial plan that will really go well for your investment objectives and goals. Aside from that they can also give you a big help with tax advice, budgeting, estate and retirement planning and many other kind of financial recommendations and advice.

Furthermore, a full service stock broker will not also help you when you buy stocks online and with other financial matters during the first month of their service. Instead, they will make sure that they will always help you in your financial needs in your whole life, if you want them to. However, when it comes to the payment, they are definitely more expensive compared to discount brokers. But the money you will be paying to them is nothing compared to the amount that you can get because of their help.

Money managers

Money manager stock brokers are somehow similar to financial advisors. However, they can take 100% decision in your account. But, there is no need for you to worry because all money managers are really professionals or has a great knowledge and experience when it comes to handling large amount of money owned by their customers. That is why they based their fees on the amount of money that you trust to them and not by your every transaction. So if you are one of the people who are very rich and still want to buy stocks online, having a money manager on your side is ideal for you.

Having a stock broker who is knowledgeable and professional enough is definitely a big help for you when you want to buy stocks online. With them, your work will be definitely lot easier compared to doing things on your own. However, you should make sure that the kind of broker whom you will be asking for help is really the right one for you not to regret it in the end.

Best ETF of the Month

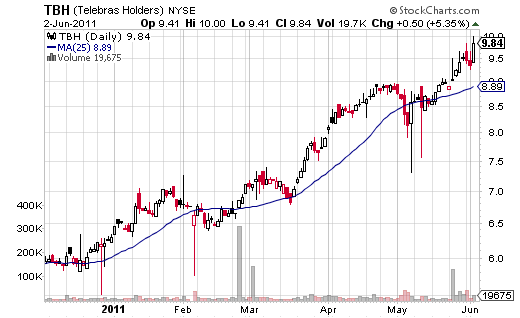

Our ETF pick for June 2011 is TBH (Telebras Holders). This ETF tracking the Brazil telecom stocks is one of the few ETFs still in a uptrend.

Remember that we do not follow our free picks and we will not issue a sell alert for this ETF on this page. Only our paid subscribers get access to our real time trading alerts.

Best ETF for April 2011

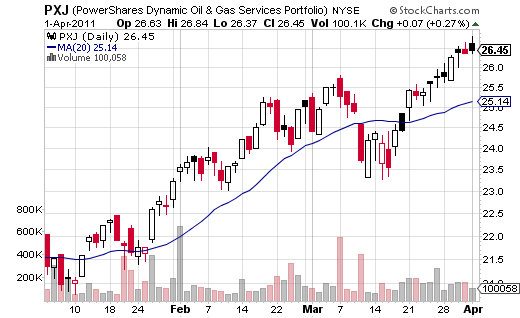

This month best performing ETF is PXJ ( PowerShares Dynamic Oil & Gas Services Portfolio ):

Please remember that this is not a trade recommendation and we do not post a sell alert for the free ETF of the Month picks. Only our paid subscribers will get specific buy and sell signals.

Top Performing ETF March 2010

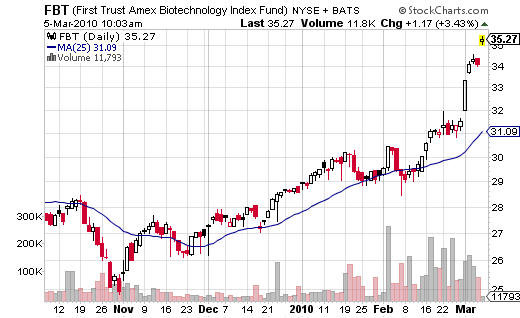

The best performing ETF this month is FBT (First Trust Amex Biotechnology Index):

Please remember that our free ETF picks are not followed (we will not email you when it’s time to sell). Only our paid members will receive exact buy and sell signals for the ETFs on our portfolio. You can find more about this here.

PS There was no free ETF pick last month because of the weak market action.

Best ETF January 2010

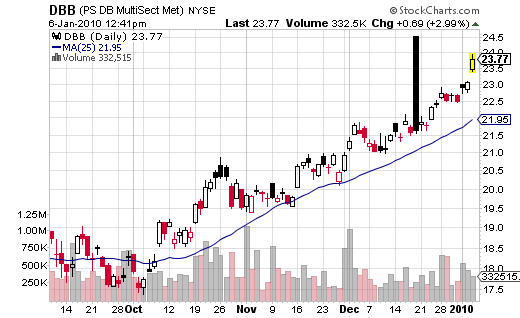

The best performing ETF this month is DBB ( PowerShares DB Base Metals ):

Is DBB still worth buying? Click here to see the Top 3 best performing ETFs right now.

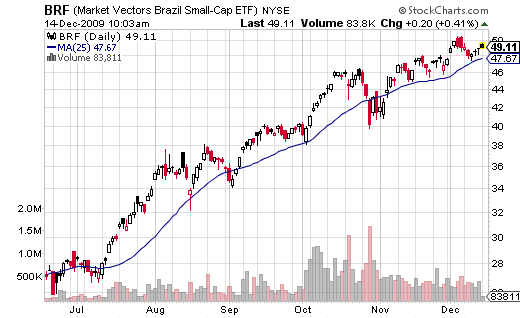

Best ETF December 2009

The ETF of the month for December 2009 is BRF (Market Vectors Brazil Small Cap):

There was no update for the ETF of the month for the last two months because our last recommendation (TUR) continued to be the best performing ETF for that period.

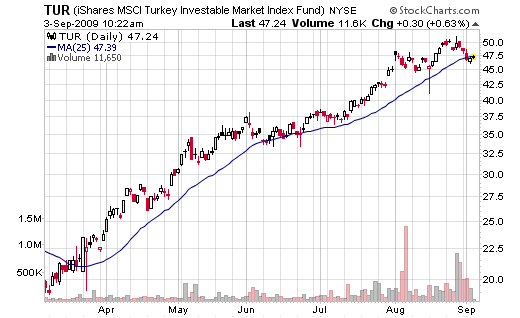

Best ETF for September 2009

The best performing ETF this month is once again TUR (iShares MSCI Turkey). The Turkish market continue its strong recovery but this may rapidly change should the pessimism return to the market. Make sure you have a clear exit strategy if you decide to invest in this ETF.

Click here to find out if TUR is still a buy and get easy to follow buy and sell signals.

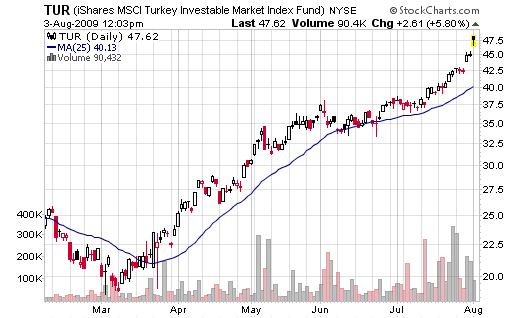

Best ETF for August 2009

The best ETF for this month is TUR (iShares MSCI Turkey). Turkish market, like any other emerging market, was down almost 70% from October 2007 to November 2008 and is recovering very well right now. How far it can go? It all depends on the overall market. If the actual optimism will continue the Turkish market will likely outperform the US and other developed countries markets but the opposite is also true, if the last year pessimism will return.

Is it still time to buy TUR today? Click here to find out.

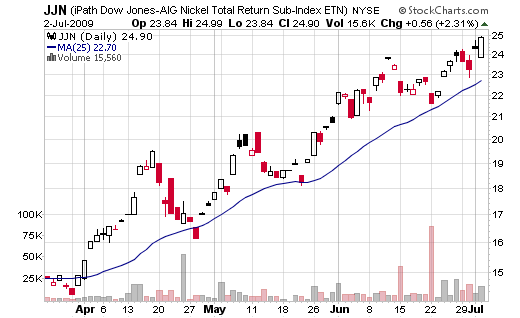

Best ETF For July 2009

This month’s best performing ETF is iPath Dow Jones-AIG Nickel Total Return (symbol JJN), an ETN (Exchange Traded Notes) in fact.

The nickel prices increased significantly during the last couple of months and this helped a lot of the stocks and ETFs exposed to the metal. Commodities prices in general were up during the last few months because investors became more optimistic that the world economy would recover and the demand for commodities would increase again. However, a return of the bear sentiment in the market will certainly take down the nickel and other commodities prices as well. You should have a clear exit strategy in place if you decide to buy this ETN.

Is it still time to buy JJN today? Click here to find out.

Best ETF for June 2009

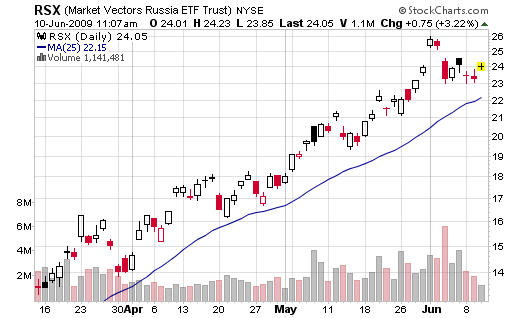

This month’s best performing ETF is Market Vectors Russia (symbol RSX). The Russian stock market, like most emerging markets, is recovering from huge losses suffered during 2008 and the first part of this year. If the actual rally persists, this ETF should continue to perform well; however, it will give back its earnings very fast should the bear market mood return. Remember, you should have a well-defined exit strategy in place before buying any ETF or any other investment vehicle, by the way.

RSX – Market Vectors Russia

Is this ETF worth buying right now? Find out what the best performing ETFs are right now and how you can improve your portfolio return. Click here to find more!

Recent Comments