Best ETF December 2009

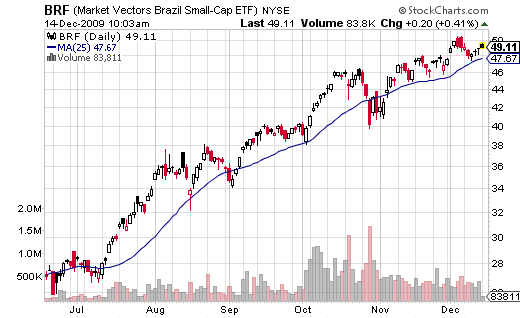

The ETF of the month for December 2009 is BRF (Market Vectors Brazil Small Cap):

There was no update for the ETF of the month for the last two months because our last recommendation (TUR) continued to be the best performing ETF for that period.

Hi,

Could you please send me or tell me where I can find a list of European ETFs, As I am very interested in ETFs and would like to , First learn more about them, and seconly find somewhere to screen these instruments. Greatly appriciated,and many thanks

reza.

Reza, in Europe every country have his own stock market and listed ETFs. You have to decide first what is the country you want to invest on then search for “ETF country name” (like “ETF UK”, “ETF Germany”, etc)

What are some of the best-rated ETFs that invest in global markets, as opposed to this month’s pick, which is focused on Brazil?

Rich, global markets are not doing very well lately and looks like we are at the edge of a trend change. There is still isolated strength in markets like Brazil but the global indexes were all flat or down the last weeks.

I was just following up on my previous question about the 60 day money back guarantee being shorter than a typical trade round turn which doesnt allow you time to complete a trade and make a judgement! Thanks, Jerry

Jerry, I consider that 60 days it is more than enough to see if our service is what you are looking for or not. Most of our competition offer at maximum 30 days. Also, one single trade is not enough to test a system, it may happen that the trade you want to ‘test’ is our best (or worst) trade ever, will that tell you something about our system? No. You should probably start by checking our closed trades and if you decide to become a subscriber make sure you do it for a long enough term, start trading small amounts and increase only when you feel confident enough in our service.